Investing 101: Stocks, Bonds, and Mutual Funds - Your Ultimate Guide

Introduction

Hello, aspiring investors! Are you ready to dive into the world of investing but find yourself confused by terms like stocks, bonds, and mutual funds? You're not alone! Investing can seem like a complex maze, but it doesn't have to be. In this blog post, we'll break down the basics of these three key investment vehicles to help you make informed decisions. So, let's get started!

What Are Stocks?

Stocks represent ownership in a company. When you buy a stock, you're essentially buying a piece of that company. Stocks are traded on exchanges like the New York Stock Exchange (NYSE) and the Nasdaq.

Pros:

- High Growth Potential: Stocks have the potential for high returns.

- Liquidity: Stocks are easy to buy and sell.

- Ownership and Voting Rights: Owning stock means you have a say in the company's decisions.

Cons:

- Volatility: Stock prices can fluctuate widely in a short period.

- No Guaranteed Returns: You could lose your investment.

What Are Bonds?

Bonds are debt securities that act like IOUs. When you buy a bond, you're lending money to the issuer (usually a corporation or government) in exchange for periodic interest payments and the return of the bond's face value when it matures.

Pros:

- Stable Income: Bonds provide regular interest payments.

- Lower Risk: Generally less risky compared to stocks.

Cons:

- Lower Returns: Typically offer lower returns than stocks.

- Interest Rate Risk: Bond prices can fall if interest rates rise.

What Are Mutual Funds?

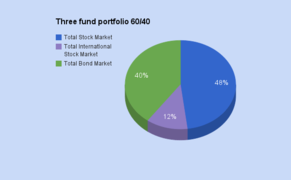

Mutual funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. They are managed by professional portfolio managers. you can read more about mutual fund on how2invest guide.

Pros:

- Diversification: Offers a mix of various asset types.

- Professional Management: Managed by experts.

Cons:

- Fees: Management fees can eat into your returns.

- Less Control: You don't get to pick individual investments.

How to Choose the Right Investment

Choosing between stocks, bonds, and mutual funds depends on various factors:

Risk Tolerance

- High Risk: If you can tolerate risk and aim for higher returns, stocks may be suitable.

- Low Risk: If you prefer stability, bonds are a better option.

Investment Goals

- Long-term Growth: Stocks and mutual funds are better for long-term goals.

- Regular Income: Bonds are ideal for generating steady income.

Time Commitment

- Active Involvement: If you have the time and knowledge, you can actively trade stocks.

- Hands-off Approach: If you prefer a hands-off approach, mutual funds are a convenient option.

Conclusion

Investing is an essential part of building wealth and financial security. Understanding the basics of stocks, bonds, and mutual funds is the first step in your investment journey. Each has its own set of pros and cons, and the best choice depends on your individual needs, goals, and risk tolerance.

So, are you ready to take the plunge and start investing? Remember, the best time to start is now!

Happy Investing! 🎉

Check more links here:

Comments

Post a Comment